Disruption, enhancements or just eating your lunch?

There is increasing talk about the impact of fintech on the Australian superannuation industry. In some circles, fintech companies are regarded as disrupters, with speculation that innovative players and technology giants such as Facebook, Apple or Google could enter and dominate parts of the superannuation value chain, posing an existential threat to traditional players. In other circles, they are seen as enablers who will assist super funds in their quest to achieve increased efficiencies, lower fees and more engaging member experiences.

The PwC 2017 global fintech survey found that 88% of financial services providers are increasingly concerned they are losing revenue to innovators, while 82% expect to increase their fintech partnershipsThere is increasing talk about the impact of fintech on the Australian superannuation industry. In some circles, fintech companies are regarded as disrupters, with speculation that innovative players and technology giants such as Facebook, Apple or Google could enter and dominate parts of the superannuation value chain, posing an existential threat to traditional players. In other circles, they are seen as enablers who will assist super funds in their quest to achieve increased efficiencies, lower fees and more engaging member experiences.

The PwC 2017 global fintech survey found that 88% of financial services providers are increasingly concerned they are losing revenue to innovators, while 82% expect to increase their fintech partnerships in the next three to five years1. The survey further revealed that more than 80% of these providers believe that part of their business is at risk of being lost to standalone fintech companies. The question is, which parts of their business are at risk and what are they doing about it?

In this paper, we take a closer look at the superannuation value chain to get a clearer picture of how fintech is impacting the Australian superannuation industry and we seek to answer the question all trustees and super funds want to know – are the fintechs capable of genuinely disrupting or enhancing Australia’s super industry, or are they just eating their lunch?

In general, fintech firms are like water; where there is a gap in your proposition they will flow into it. Where there are obstructions creating friction in your processes, they will flow around it and they will head straight for the deep pools of profit in your business.

The Superannuation Valua Chain Defined

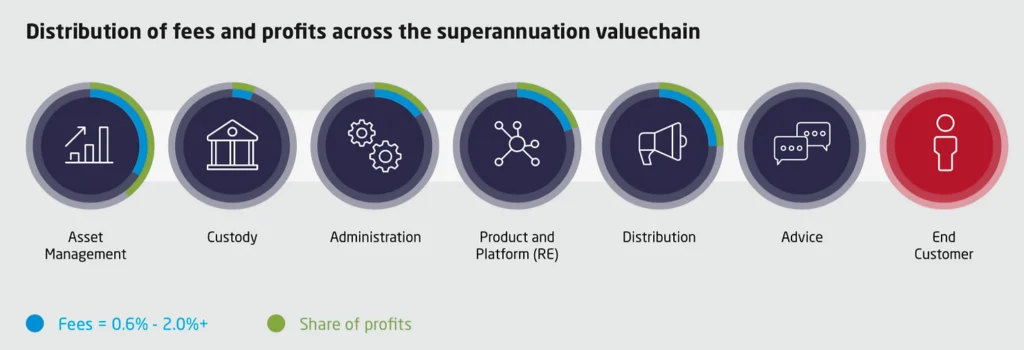

Asset management

At one end of the superannuation value chain is asset management. Depending upon the fund, it can be delivered by an in-house team, outsourcing to asset managers, or adopting a multi-manager approach. There are numerous participants within this space, including asset managers and asset consulting firms. Traditionally, this part of the value chain has been the most lucrative in terms of revenue and profits. However, increases in passive investment approaches and the introduction of MySuper have put downward pressure on fees and margins in this space.

Custody

The next part of the value chain is custody. Selected financial institutions such as investment banks

and global custody agents serve as custodians by holding securities for guaranteed safekeeping on behalf of superannuation trustees. The custody and fund administration industry provide investment administration such as valuation, tax and statutory reporting and unit pricing services. Custody is built on scale and while the percentage of fees received by custodians is small, the incremental profit from additional funds under management can be sizeable. The focus of providers in this space is to have automated and streamlined processes to take advantage of scale.

Administration

Towards the middle of the value chain is member administration, which can be delivered by an in-house team or by outsourcing to third party administrators, master trusts and offshore partners. Administrators rely on having efficient and robust registry and surrounding technology to streamline processes, reduce costs and ensure strong compliance. This space has a high level of complexity and compliance burden, which is the primary reason that it is heavily impacted by the regulatory changes imposed by governments and regulators. It typically receives a modest share of the fee revenue but without scale it is difficult to generate significant margins.

Products and Platform

At the centre of the superannuation value chain is the provision of products and platforms by the responsible entities that support super funds. These include fund trustees and often, financial institutions and industry funds. This is where the propositions are put together and fund regulatory compliance is important. It is also where many relationships are forged with other players that augment the superannuation value chain, such as life insurance and retirement product providers, adding to the revenue and profit streams of the funds. Like administration, the products and platforms space receives a relatively modest share of the fees, and must deal with increasing compliance and regulatory burdens.

Distribution

Distribution refers to the way in which propositions are delivered to market. It can be handled by in-house marketing and sales teams, financial planners and their dealer groups, marketing through affinity groups or even direct to customer (D2C) and white label solutions. As with all industries, distribution is an important part of the value chain and attracts a reasonable percentage of the fees and profits. This is due to the lower levels of regulatory complexity, easy access to customers and healthy margins it affords.

Advice

An increasingly important part of the superannuation value chain is advice and education. Traditionally delivered by in-house advisors, financial planners and accountants, this space is increasingly being facilitated by robo and hybrid advice solutions. Due to recent regulatory changes, the fees for advice – which can vary significantly depending on the type – are now highly transparent to the end customer.

End customer

The superannuation value chain culminates in the end customer – the fund member. As the name suggests, each component in the chain should ‘add value’ to the retirement outcomes of members. In recent years, there has been a high degree of scrutiny on the fees charged to members across the value chain, with the latest Productivity Commission review continuing to put downward pressure on fees. With the introduction of basic MySuper offerings, fees to the end customer have reached as low as 0.5-0.6% per annum (without advice)2.

CURRENT STATE OF PLAY: A TALE OF TWO SUPERANNUATION MODELS

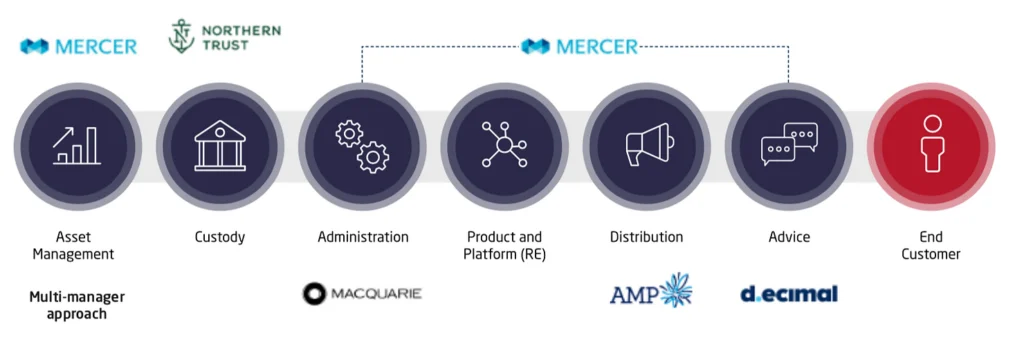

A breakdown of the superannuation value chain reveals the significant complexity and fragmentation of Australia’s super industry – with the emergence of two distinct models of superannuation. The first is a conglomerate model, where many different providers come together to operate best-of-breed services within each part of the value chain. The second is a vertically integrated model, where an individual superannuation provider seeks to deliver across most parts of the value chain, with very little input from other providers.

Many super funds, including industry funds, typically adopt the conglomerate model3. Within the asset management space for example, most industry funds engage numerous investment managers from various external asset consulting firms to oversee a good part of their investment funds. Within the custody space, services are handled by an external custodian and the administration is outsourced to a specialist provider. The super fund itself directly handles only a relatively small portion of the value chain – usually the responsible entity and distribution components.

Conglomerate superannuation model – many providers involved

Some providers in the Australian superannuation marketplace opt for the vertically integrated model. For example, a closer look at the likes of Mercer or Rest (one example among many in the market) shows that far more of the value chain is handled by the fund provider4.

*not all third parties are shown on this diagram

This approach gives the provider far greater control and flexibility in deciding where and how they charge their fees and make their money across the entirety of their operations. Providers must have sufficient scale and expertise to make this approach viable.

Vertically integrated superannuation model – one key provider involved

It is evident that there are many existing players already involved in the value chain, in addition to the trustees and the super funds themselves. Even those industry funds who promise ‘all profits to members’ have a substantial amount of fees being directed to profit-

making third parties. The most significant takeaway is that even before we consider the entry of fintechs into the market, the superannuation industry already has a lot of mouths to feed.

WHERE FINTECH HAS FOCUSSED

While fintechs are emerging across all parts of the superannuation value chain, they tend to be more heavily represented in the spaces with the least complexity and regulatory compliance and the most margin.

Asset Management

The dominant focus of fintech start-ups has been within asset management, which is being disrupted by new platforms centred around social media and community-based investing. This activity initially took the form of US-styled robo-advice with simple needs analysis leading to a portfolio choice, and later evolved into areas such as social network investing and the use of enhanced AI in trading solutions. New trading platforms have also emerged that enhance the diversity of investments offered by a fund, but also potentially attract investments away from super into alternate vehicles. We are witnessing the rise of platforms offering access to previously unavailable assets such as property and infrastructure, as well as lower cost, self-directed D2C style offerings based around guided robo-advice.

Custody and Administration

In the custody and administration spaces, fintech activity has focussed on improving efficiency and compliance. New technologies such as blockchain and the New Payment Platform initiative should lead to improved efficiencies around the movement of money and the registry of asset ownership. These technologies may eventually remove the need for custody altogether, but this is a long way off. In administration, the focus is on automation, straight-through processing and the use of workflow and robotic solutions to automate previously manual processes. In both the administration and product and platform spaces, ‘regtech’ is emerging as an important area of focus for fintech. These solutions are seeking to reduce compliance risks through reviewing and streamlining processes and employing big data and AI-based analytics. Initially, the focus was on the digitisation of manual reporting and compliance processes, such as the Know Your Customer (KYC) requirements. More recently, regtech solutions are allowing providers to boost their responsiveness to regulatory changes, given their ability (at least in theory) to adapt dynamically to new requirements.

Distribution

The most serious disruption to super funds is occurring in the distribution space. Given its lower levels of regulatory complexity, easy access to customers and healthy margins, new marketing- based start-ups with no experience in superannuation are entering the market. Through social media and new digital approaches to distribution, new start- ups such as Spaceship, Zuper, Grow and Mobi are successfully attracting the Millennials cohort away from direct relationships with traditional providers. These firms could more aptly be described as digital marketing businesses that cleverly employ social media and gamification to tap into the Millennials market. They are using distribution as the means to steal business away from established players, but are still relying on various providers to deliver the other pieces in the value chain. While these offerings are not always benefiting end consumers through better net returns or improved products and services, they are meeting member expectations for heightened levels of engagement5. Established funds wishing to defend their market share will be forced to consider more innovative distribution methods that employ social media marketing and gamification to gain traction, particularly with Millennials.

Advice

The advice space has also attracted a reasonable amount of fintech activity with the emergence of robo and hybrid advice solutions. These solutions seek to educate and guide superannuation members through an advice journey. In many cases, they are being used to supplement face-to-face advice, which is needed when issues become more complex. In this space, new technologies are streamlining the advice and acquisition process by automating statements of advice, as well as workflows to enact the advice. Communication with members is also being improved by chatbots powered by artificial intelligence (AI) and automated solutions facilitating video conferencing. With customer interaction as their core function, fintechs in this space are highly focused on providing real benefits to customers. These providers pose less of a threat to super funds than they do to traditional advice solutions in the market.

In the same way that traditional media players now supply news feeds to Facebook and Google for distribution, is it possible that existing super funds will soon become wholesalers that supply super products to fintech front-end distributors? The desire to ward off this form of disruption is reflected in the 2017 PwC global FinTech survey, which found that the

top three technologies financial services firms plan to invest in are data analytics, mobile and AI – all key tools in the distribution space.

DISRUPTION, ENHANCEMENT OR JUST EATING YOUR LUNCH?

Looking closely, very little true holistic disruption is occurring within the Australian superannuation market, with most fintech entrants enhancing rather than disrupting the other pieces within the value chain. Particularly in the custody, administration and platform spaces, partnerships between fintechs and superannuation providers have helped improve the operation of super funds and their offerings to members. Examples include efficiency in payments and messaging, compliance and regtech, and robotic automation solutions to remove manual processing. While super funds and their members stand to benefit from these new arrangements, suppliers of the services being replaced will experience disruption to their business models.

Within the asset management space, we are seeing fintechs pinching some margin and putting pressure on existing players to innovate their offerings. In some cases, asset managers are benefitting from fintechs that help them enhance their offerings through improved big data and AI-based investing capabilities. In theory, these partnerships should lead to better net returns for members and are worth watching as their experience unfolds.

Overall, even though a few existing players are losing some of their margin to new start-ups, it can be argued that it amounts to little more than the fintechs eating their lunch. It begs the question: If fintechs are simply taking margin away from existing participants in an already crowded space, are they adding genuine value to the superannuation value chain? To date, while there is an emerging group of fintechs seeking to work with existing providers to improve efficiency and regulatory compliance, so far, the majority of fintech activity in superannuation has shown little evidence of improving the net return position of the funds or enhancing benefits to members.

WHY HAS FINTECH HAD LITTLE IMPACT WITHIN AUSTRALIA’S SUPER INDUSTRY?

Given the lower levels of fintech activity in Australia’s super industry compared to other industries, it is interesting to consider why fintech has had little impact on providers. There are three main reasons.

Firstly, more extensive fintech involvement has undoubtedly been thwarted by the proactive supertech measures many existing providers have already taken to move their businesses towards more digitally engaging solutions for their end customers.

Secondly, when you consider the driving forces behind most start-ups, a pattern emerges – they typically target gaps in propositions and excess margins left up for grabs by established players. So, when you consider where the fintechs have concentrated their activity in Australia, it is clear they have singled out lucrative industries such as banking, lending and payments, and real estate, where there are easy gaps to fill and significant money to be made. In the superannuation space, they have similarly chosen to follow the money and focus almost exclusively on those areas in the value chain with the highest margins and lowest regulatory impact – asset management and distribution.

Thirdly, the complex nature of the Australian superannuation industry has served to dampen fintech interest in the sector. The super industry is already quite fragmented, with many mouths to feed. Combined with recent downward pressure on fees, this has resulted in margins that are relatively modest when compared with other industries. Add to this mix a constantly evolving and complex regulatory environment and this explains why fintechs have been slower to enter the industry.

For these same reasons, it is equally unlikely that one of the tech giants – such as Google, Apple or Facebook – will enter the Australian super industry anytime soon. Concerns that these players will wreak havoc with a holistic offering across all aspects of the value chain are premature at best. In the immediate future, there are much more lucrative markets for them to go after.

Rather than taking on the entire superannuation value chain, there is a possibility that tech giants such as Google or Facebook might choose to target its most lucrative area – distribution. Should they choose to go down this path, these tech giants could bring about considerable, but not holistic, disruption by turning many of the traditional participants into wholesalers.

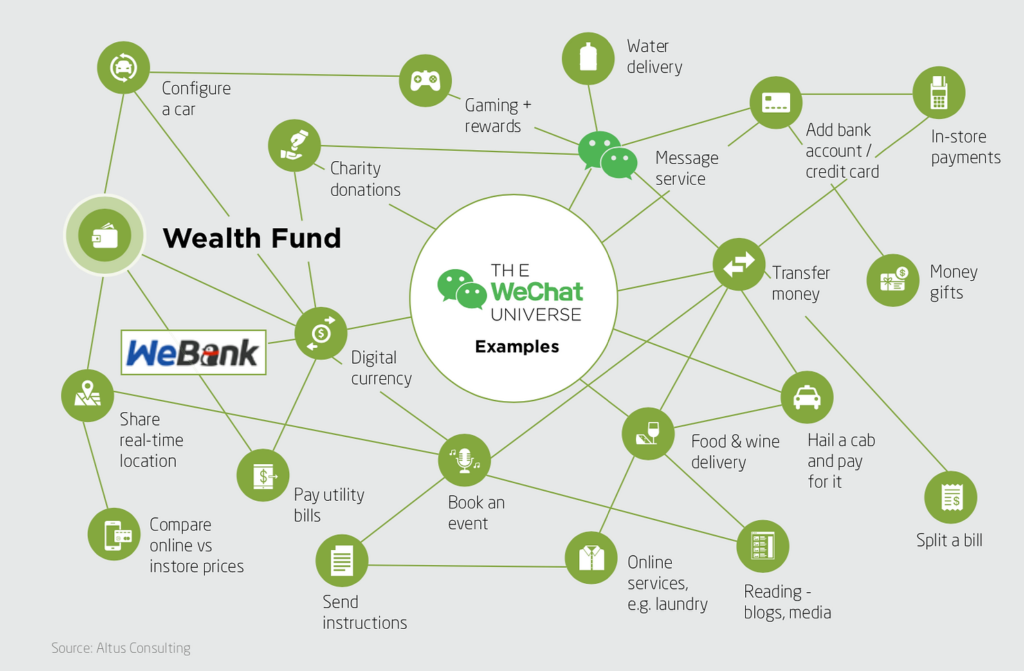

WHAT COULD TRUE HOLISTIC DISRUPTION LOOK LIKE?

Perhaps the best global example of true holistic market disruption is the WeChat phenomenon in Asia. Starting out as a social media platform, it has now morphed into a ‘platform as a market’ concept that has enjoyed unprecedented success. Having experienced over 200% growth per annum since its inception, the universal app now provides a whole ecosystem of products and services, backed by its own bank and wealth fund. More than 10 million people have invested money into the fund, which has assets totalling over US$16.2 billion6. Most notably, the platform is dominating multiple lines of business and disrupting many established players across many markets

Within the Australian superannuation space, the SMSF sector is an example of holistic disruption. In the near future, it is possible that the SMSF model may lead to new approaches that turn the traditional superannuation value chain into a ‘platform as a market’ model that places the end customer – the member – at its centre. This would have profound implications for the future of the Australia’s super industry. Would all of the traditional players still be required, or will some be forced to transform into new types of providers? Would blockchain technologies coupled with new payment mechanisms remove the need for custodians and would there be a need for responsible entities? Would asset managers and insurers gain direct customer access? And would the platform, distribution and advice segments merge to become aggregators of customer information across multiple lines of business beyond superannuation and retirement?

A BLUEPRINT FORSUCCESS

Fintech activity within Australia’s superannuation industry is undoubtedly on the rise. To prepare for and benefit from this changing landscape, existing providers should:

- Identify where they operate in the superannuation value chain

- Understand the value they contribute and how this value can be best delivered and articulated to members

- Clearly understand what their target customers want

- Pinpoint areas within their operations that are most likely to attract disruption.

- Identify gaps in the proposition and/or customer friction points. Watch carefully those areas with healthy margins and strong profits

- Develop a plan that sets out their strategy for responding to fintech activity. Does their business intend to partner with, buy, compete with or ignore the new entrants?

- Where necessary, upskill and invest in their people to implement their fintech strategy

Being prepared is not only the best defence for superannuation providers, it also opens the door to considerable opportunities.

CONCLUSION

Contrary to the hype, fintech players in the Australian superannuation industry have been neither the harbingers of doom nor the panacea for the industry’s ills that some anticipated. The onus remains on the industry to ensure that genuine value is added to members across all aspects of the superannuation value chain. Trustees and funds must focus on delivering their members holistic and personalised offerings that provide healthy investment returns, lower fees, diverse retirement products, appropriate insurances, and affordable advice, education and advocacy.

The way in which the industry achieves these goals is likely to change. The superannuation value chain, as we know it, will evolve into a customer-centric ‘platform as a market’ model in which the roles of existing players will merge and fintech involvement will increase. In this changed landscape, there will be a greater need for traditional superannuation participants to seek out partnerships with fintechs that can enhance their offerings to achieve a much broader proposition, even beyond superannuation. Providers must ensure the member is at the centre of the proposition and must focus on delivering the benefits their members really want.

While the Australian superannuation industry has been relatively sheltered from disruption to date, it cannot escape the next wave of change. The key to surviving holistic disruption will be the capacity of superannuation providers – both established players and fintechs – to deliver genuine value to the end customer – the member.

END NOTES

https://www.pwc.com/jg/en/issues/redrawing-the-lines-fintechs-growing-influence-on-the-financial-services-2017.html 2. https://www.wealth.anz.com/superannuation/smart-choice-super

- http://www.rest.com.au/about-rest/our-service-providers

- https://www.mercer.com.au/about-mercer/lines-of-business/investments/mercer-super-trust.html

- https://www.spaceship.com.au/fees/

- https://www.techinasia.com/wechat-investment-fund-10-million-users