Introduction

A number of years ago, Bill Gates presciently observed that: “Banking is essential, banks are not”. In the interim, we have seen the emergence and rising popularity of peer-to-peer lending, crowdfunding and new payment platforms, along with disrupters like Apple and PayPal, all pushing their way into the traditional banking domain. On the back of this experience, the key question is whether the superannuation industry – including SMSF providers – are destined to suffer the same fate? While extensive regulation, historic distribution channels and compulsion have offered providers some level of protection from disruption to date, is this all about to change?.

There is a substantial buzz around the use of technology in the wealth management industry. Much is being said about the Fintech revolution and there is intense interest in everything from social media, Bitcoin and Apple Pay, through to robo-advice and the Internet of Things.

This paper will narrow its focus to the five key trends currently having the greatest impact. Centred upon generation changes and advances in technology, these trends are transforming the provision of platforms, products, services and advice across the wealth management sector. They are:

Generational change

Hyper personalisation and customer-centricity

SMACI – Social, Mobile, Analytics, Cloud and the Internet of Things

The Fintech revolution

Cyber security and privacy.

Generational change – The rise of the Millennials

A defining trend of our age, generational It’s clear that generational change is fuelling demand change is pulling the wealth management industry in all directions.

As the Baby Boomers enter retirement with considerable savings, they are sparking a flurry of activity around new retirement products and strategies. Faced with increased longevity, super funds are grappling with how to best protect these savings, while also providing appropriate levels of income and capital growth. Funds historically not associated financial advisers are now entering into partnerships to support the complex needs of retirement planning.

The next round of accumulators, the Millennials represent the most significant drivers of the wealth management business in the years to come. As digital natives, this group has heightened expectations around service delivery, preferring to research and transact almost exclusively online, though they still value face-to-face support for more complex decisions. The Millennials desire control over their finances, but are thinking about saving, much more than investing. They rely heavily on their peers and social media and prefer financial ‘coaching’ to advice. Importantly, the Millennials are not averse to changing brands and providers if they perceive better value elsewhere.

In the middle are Gen X, who are worrying about how little time is left to squirrel away enough money to support 30 plus years of retirement. The needs of Gen X centre on education, planning tools and support and, like the Millennials, they expect this to occur online. This group tends to be much more self-directed in their investment decisions and this has been reflected in the continued rise of SMSF’s and IMA/SMA products in the marketplace.

It’s clear that generational change is fuelling for demand retirement product innovation, ‘omni channel’ digital delivery, social media strategies, online education, scalable financial advice – including robo-style offerings – and even D2C solutions. This demographic evolution makes it critical for providers to develop personalised solutions and servicing models that directly address customer needs at their various life stages.

Implications for SMSFs

In the immediate future, the challenge for the SMSF sector is to offer a servicing model that meets the expectations of the next generation of investors, the Millennials. This cohort demands mobile and digital service delivery and seamless, real-time information, advice and transacting. Interestingly, many solutions targeting the Millennials also work well for other generational segments. That said, care should be taken to avoid a broad-brushed approach. As we discuss below, a strong desire for highly personalised offerings continues to dominate across all demographic groups.

2 Hyper-personalisation and customer-centricity – Personalising the customer journey

Whereas the buzz was once around member engagement, this has now evolved into a focus on member experience, which is all about personalising the customer journey. Hyper-personalisation involves the use of data from various sources to provide more personalised and targeted products, services and content. The focus is upon achieving customised solutions that better satisfy customer needs and expectations.

In the pursuit of hyper-personalisation, many wealth management providers are building specialist teams of data analysts and creating large datasets – big data – around individual customers. These datasets link data from internal systems to data from other sources such as industry and social media. Increasingly, datasets are incorporating data from social media, to capture the personal preferences and behaviours of customers

– such as when, where and how they like to interact online.

Some providers are putting in place ‘labs’ that employ design thinking techniques to help develop the kinds of solutions their customers actually want. Others are replacing group targeted or bulk production of generic communication with ‘message-to-one’ approaches. Although the core message may be the same, providers are communicating directly to individual customers using their preferred language, style and communication channel.

It is important to know when and how often to use hyper-personalisation. If employed too little, there will be missed opportunities on both sides of the equation. If employed crudely or too often, without tangible and immediate customer benefits, providers risk being viewed as cyber-stalkers by their client base.

In recent years, we have begun working with clients to develop responsive solutions that seek to proactively enhance individual user journeys by integrating learnings from big data and analytics into business processes and systems. Using a combination of analytics, rules and workflow engines, it’s possible to establish processes that will vary based on certain trigger events. It’s also possible to identify clients who are ripe for up-selling or cross-selling, as well as those who are a potential flight risk.

Implications for SMSFs

The ability of SMSFs to take advantage of hyper- personalisation is mixed due to the industry’s scale and fragmentation. From an IT perspective, most providers will lack the budgets needed to invest heavily in big data and analytics. However, all is not lost. What the sector does have on its side is a unique history of close, one-on-one relationships with clients. SMSF providers must consider how best to leverage their strong customer relationships to deliver more personalised offerings. For many, the answer will lie in employing modern, customer-centric platforms capable of delivering optimal member experiences. Platforms of the future must support hyper-personalisation through targeted interactions and communications, seamless real-time integration and ‘omni channel’ digital service delivery.

3 Technology – Exponential changes in technology6

We are witnessing exponential changes in technology, Cloud and ‘as a Service’: with five key trends in particular impacting the superannuation and wealth management space, often referred to as SMACI – Social, Mobile, Analytics, Cloud and ‘Internet of Things’ (IoT).

Social: All generations are now interacting on social networks and increasingly using these networks to source information and gain peer recommendations. Providers need to build a strong presence on the social networks most frequented by their existing and potential clients. They must also appreciate the value of social listening as a means of monitoring their business reputation. Increasingly social networks provide an important channel for marketing and communication, as well as servicing customer complaints.

Mobile: According to recent research, 7 in 10 Australians use three or more mobile devices1. Smartphones dominate, while tablets are on the rise, with 81 per cent of smartphone users accessing the internet on their mobile2. In April 2015, Google’s search engine expanded its use of mobile friendliness as a page ranking measure. Apple now provides a seamless experience that allows you to move from your desktop to your mobile device and pick up where you left off.

In this new world order, it is critical for wealth managers to provide ‘omni channel’ digital service delivery 24/7, with as little friction as possible across mobile, web, phone and face-to-face channels.

Analytics: As noted above, big data and analytics are essential tools in the provision of hyper- personalisation. As the field of analytics has evolved, we’ve seen big data employed in increasingly inventive ways. Smart Data refers to the use of algorithms to turn seemingly meaningless information into actionable insights. Fast Data involves applying ‘as it happens’ information in real-time to enhance product and service delivery to customers. Many larger organisations are now investing heavily in the technology and expertise needed to capitalise on analytics.

Increasingly, providers are turning to Cloud and ‘as a service’ solutions to provide scalable access to hardware and software on a user pays, as needed basis. You no longer need to buy storage devices for your big data, extra CPU’s for your analytics or employ a large IT department with specialists who know every piece of the solution. Hybrid cloud environments are proving popular, allowing less sensitive information to be stored in a public cloud and commercial-in-confidence data in a private cloud. Many SMSF providers have already been exposed to cloud accounting and other services and it’s likely this trend will extend into most other areas.

Internet of Things: By 2020, Gartner expects there will be more than 26 billion connected devices in use globally3. This interconnectivity, known as the IoT, is transforming the way in which we live, work and play. Most notably, IoT delivers the ability to constantly monitor a whole range of variables, including personal behaviours and preferences. We are already seeing its application within insurers to rate the health of their client base and reduce claims costs. It’s only a matter of time before the superannuation industry feels its effects.

Implications for SMSFs

The tools already exist for even the smallest SMSF provider to realise the benefits of most aspects of SMACI. To meet customer expectations, providers must employ social media strategies and responsive digital platforms capable of delivering consistent user experiences across multiple devices, particularly mobile. Accessible 24/7, your offerings must support seamless, real-time transactions, including those from third party providers. SMSF providers should take advantage of leading edge technology, expertise and data storage solutions offered by cloud and ‘as a service’ offerings. You must also seek to combine your more intimate knowledge of your client base with an appropriate CRM solution to deliver more highly personalised experiences and offerings.

4. The Fintech revolution-

Holistic customer views that fill service gaps in traditional platforms continue to see a proliferation of new Fintech solutions that are employing technology, not only to fill service gaps left by existing providers, but also to substantially reduce margins. There are four key groups dominating the Fintech boom.

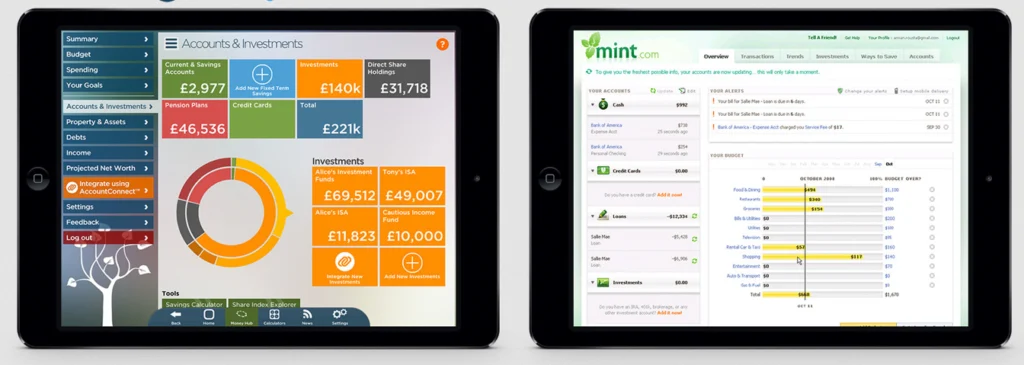

Aggregators: We are witnessing the rise of players seeking to provide more holistic solutions to clients. The most notable player in this space has been Yodlee, a start-up that developed software and tools allowing companies to provide an account aggregation service to their customers. By providing a one-stop-shop that brings together customer accounts from many sources, these services allow for comprehensive expense management, bill payment, budgeting, savings, investments and financial wellness assessments and projections. Aggregators are breaking down barriers in areas such as payments and money transfers.

Robo-advice: Perhaps the most talked about trend in the wealth management sector is robo-advice. In the US and UK, robo-advice offerings have emerged as the backbone behind a number of D2C platforms. These solutions essentially automate risk profiling and then apply an appropriate investment model developed internally or through a multi-manager approach. We have already seen players like Decimal operating in this space for a number of years and more recently Yellow Brick Road launched Guru to assist their clients and advisors. The pressing question is whether robo-advice is going to replace advisors or instead be integrated into advice models provided by licensees and platform providers.

Disintermediators: Another group with the potential to impact the superannuation sector are the new D2C offerings, such as Wealthfront in the US and Nutmeg in the UK. These players rely heavily on robo-advice and take advantage of cloud technology and digital channel delivery to bring low cost solutions to market. In Australia, however, D2C superannuation offerings have largely failed to gain traction, while D2C SMSF automated solutions have also met with limited success.

Social traders: This group of Fintech firms – such as Ayondo, Covestor and Selfwealth – take the D2C offerings one step further to build social networks of similar investors. Social trading platforms allow investors to follow other successful investors’ portfolios, create and invest in similar portfolios and then compare performance.

The true strength of the Fintechs lies in their ability to deliver platform capabilities such as distribution, robo-advice, education and transactions in a much more customer-centric, personalised and holistic way.

Implications for SMSFs

So what can the SMSF sector learn from the Fintech revolution? More than anything, it emphasises the importance of understanding where your business fits into the value chain. In the quest to deliver more holistic solutions to clients, SMSF providers must be honest about the things they do well and the things best left to a third party provider. You shouldn’t be afraid to team up with the Fintechs to fill gaps in your proposition. In particular, you should look to integrate financial advice – supported by robo-advice tools – into your solutions. In the years ahead, carefully crafted joint offerings will be an effective means of competing with the new platform solutions put in place by the large superannuation providers. Your business must also ensure its processes are as efficient as possible and be capable of having its margins squeezed.

Cyber security and privacy- Protection of your most prized assets–

As more data is collected and stored in the cloud Evaluate vendors: Ensure vendors have appropriate and clients increasingly access data and transact via multiple mobile devices, new challenges are emerging around cyber security and privacy. These challenges are magnified when providers mash up various solutions from third party providers and the number of integration points balloon. They are further exacerbated by data sprawl within organisations. How many times do you see data extracts passed around your business? Do you know where all your sensitive data is held and are appropriate measures in place to keep it safe?

According to a PwC report, detected security incidents have risen by CAGR 66 per cent since 20094. In 2014, an estimated 42.8 billion security incidents were reported, which amounts to approximately 118,000 incidents per day4. In fact, this figure is likely to be far worse, given that estimates suggest only 30 per cent of incidents are reported. Also in 2014, a review by Veda found that identity fraud had increased 103 per cent on the previous year 5.

In this context, it is critical for providers to thoroughly understand not just their own processes and systems, but also third party interactions, and apply this knowledge to establishing appropriate protection at all points in the business chain. An effective cyber security framework should:

Identify areas of risk and extent: Pinpoint vulnerable spots in your business chain, such as data spread across multiple systems, multiple connected devices, clouds and third party integration.

Know what to protect: Prioritise your security initiatives, as not all activities carry the same risk. Data security and privacy, transaction capability, identity management and intellectual property are paramount.

Know how to protect it: Employ multiple security measures such as software and encryption, monitoring and audits, passwords and authentication, biometrics, training and data separation.

Plan and review security defences regularly: Employ plans, protocols and systems that are regularly tested and updated, acquire and review insurance and consider war gaming simulations.

Privacy

Existing privacy legislation predates and in some ways falls short of addressing risks created by the rise of digital communication and the use of big data and predicative analytics. As a result, there are a number of areas that providers should carefully consider when using customer data. Customers must retain individual control over their personal information and your privacy and security practices must be transparent, easy to uderstand and accessible. Data used internally and externally must be anonymised to protect the individual’s identity and data must be kept up-to-date and accurate. Every effort must be made to ensure big data and analytics do not result in inappropriate and discriminatory customer profiling.

Implications for SMSFs

The cyber security and privacy concerns facing the SMSF sector are no different to those facing the broader wealth management industry. To fully leverage the many benefits of the digital age, SMSF providers must ensure the cyber security and privacy challenges associated with real-time digital transactions, third party integration and cloud based offerings are carefully managed. See ‘Cyber Security Tips and Hints’ at the end of this paper for more useful cyber security information.

Analysis:

What does all this mean for the SMSF sector?

Competition is heating up As a direct result of these five key trends, competition within the superannuation space is heating up, as providers look to employ technology and partnerships to substantially improve their offerings. Some key of competition to the SMSF sector include:

Member Direct Investing: Industry and retail superannuation providers are adopting this approach in an attempt to stem the loss of high balance clients to SMSFs. While there are mixed reports about the success of these costly implementations, they are attracting a degree of interest. Member communication around these offerings, such as the CBUS Super Self Managed option, make it clear they serve as direct competitors to SMSFs.

Financial planning alliances: With increased exposure to more complex self-directed investing, many funds are actively putting in place alliances with financial planning firms. Once again, CBUS provides an example, having forged a partnership with the Financial Planning Association. Similarly, SMSF providers must find a way to respond to members’ increased demand for advice.

Retirement product innovation: Providers are introducing improved retirement products – such as pooled investment options and new life and variable annuities that aim to provide flexibility, while also managing longevity risks, capital control and income volatility. It’s increasingly important for SMSF providers to retain flexibility in retirement planning and possess the capabilities to maintain assets on a segregated basis.

Return of the mutual concept: Unisuper and others are researching the revival of Collective Defined Contribution schemes, which are also gaining traction in some European countries with large defined benefit sectors.

New investment vehicles: Totally new offerings are being launched such as fractional property investing, the ASX mFunds platform and wholesale investment options providing access to infrastructure assets.

Aggregation services: Other providers are following the lead of ANZ, who many years ago launched Money Manager in conjunction with Yodlee to provide their customers with an account aggregation service that provides a holistic view of their finances.

Artificial intelligence: ANZ is further extending its use of technology, partnering with IBM’s artificial intelligence (AI) solution, Watson, to develop automated intelligent statements of advice. In the years ahead, we are likely to see more application of AI in the superannuation space.

Big data and analytics: The big banks are turning to big data and analytics to deliver vertically integrated, cradle-to-grave and holistic wealth management solutions for their client base. Analytics are being employed to achieve more highly personalised products and services, optimise cross-selling opportunities and increase customer satisfaction and retention.

Simplification: The banks are also moving to simplify their superannuation offerings, reduce investment choices and support the MySuper regime. They have selected their target markets and are working on delivering a broader set of distribution channels.

Robo-advice: This approach is being integrated into platforms to provide a level of scalable, real-time advice. The use of automated robo-advice for simpler financial matters, allows financial advisors to focus on the areas they provide the most value to customers – more complex financial planning.

Holistic cross-sector offerings: We are seeing providers from one sector, such as superannuation, working with aggregators to create one-stop-shops that offer clients super, credit cards, mortgages and other financial products. Some boutique platforms are gaining traction by providing solutions that cover not just SMSFs, but also the clients other investment portfolios through IMAs and SMAs.

Social investor networks: At least one social networking robo-advice platform is now actively targeting the SMSF sector with a strong value proposition that assists self-directed investors to connect with their peers in a community of investors.

Member experience: While the member experience is in its relative infancy compared with other industries, it is now common to see gamification and other engagement activities across platforms, such as the online solution at Suncorp and AMP’s new Bucketlist campaign.

Predictions:

What the future holds for SMSFs – Challenges abound

Against the backdrop of increased competition in the superannuation space, there are a number of predictions that can be safely made about the future of the SMSF market.

Price and margin compression

It is without doubt that the SMSF sector will experience increasing price and margin compression in the years ahead. Effective responses will see:

compliance aspects automated and commoditised administration and audit outsourced and offshored robo-advice and social networks utilised in the investment and scalable advice side of the value chain.

New business pressures

SMSF providers will face new business pressures as result of social and technological change. As a result, we are likely to see:

platforms aggressively competing to deliver customer-centric and personalised solutions

continued SMSF grow, though it will become increasingly difficult to access and secure the next generation as clients

potential disruption from new D2C entrants.

Advice and servicing models

The SMSF sector will be compelled to review its advice and servicing models. In the years ahead:

licensing arrangements will force the sector’s hand, as evidenced by the recent CPA initiative

strategic advice will dominate

SMSFs will need to partner with planners who will focus on financial coaching for younger clients and more complex retirement and estate planning for older clients.

Conclusion

In the years ahead, the ability of SMSF providers to retain and expand their client base, compress margins and grow profitably will depend on their response to the five key trends outlined in this paper.

In order to compete effectively with the large super funds and the Fintech disrupters, you must cater for generational and social change and proactively employ technology to deliver more personalised and holistic offerings. Where necessary, you should consider partnering with others to fill the gaps in your service provision, but ensure the security and privacy of your customer data is adequately managed.

To meet increasingly sophisticated customer expectations, your solutions must feature customer-centric, service oriented architecture and flexible core systems with modern integration capabilities. They must support ‘omni channel’ digital service delivery informed by big data and analytics, as well as drive cost efficiencies through real-time, straight through processing and seamless, yet secure transactions with third parties.

Ultimately, the successful SMSF providers of the future will be those who provide the holistic, personalised user journeys customers increasingly expect. This will involve embracing both digital and face-to-face channels to provide the right balance of access to information and transaction capabilities, backed by expert advice when needed.

Tips and Hints

1. Consider the cost to your organisation of a serious cyber security incident

- Who would benefit from having access to your information?

- Use this to help determine whether you require cyber security insurance.

2. Choose your technology partners wisely

- Your technology partner should be able to advise you on appropriate security controls for your business.

- They must be a reputable company and have your best interests in mind when providing a solution.

- They must be trustworthy and have credible experience (i.e. small businesses are not generally going to be technology experts).

3. Install antivirus/malware software

- Such software is a key defence against viruses and malware infections, which have the potential to destroy all your hard work.

- Make sure the software is installed on every workstation and server you use.

- Make sure it is kept up-to-date (i.e. good antivirus software has auto-update mechanisms).

4. Patch your systems frequently

- Your workstations and servers must be patched when patches are released. Patches can stop the bad guys from gaining access to your systems and help prevent the proliferation of viruses and malware.

- This applies to your operating system (i.e. Microsoft Windows, Apple OS X, Linux) and any third party application (i.e. Adobe Reader, Flash Player, Google Chrome, Firefox, Microsoft Office, Java, etc.).

- Microsoft Updates can only update Microsoft related products. Make sure your other applications are set to automatically check for updates.

5. Embrace the cloud

- Your business is probably not building data centres and you probably don’t want to spend your capital on IT personnel to support your systems.

- Cloud services such as Google Business and Office 365 can lift the burden of managing IT systems such as email and file servers from your business. This can help you focus on the things your business does well.

- Cloud providers look after the security of their systems. A security breach to your service will not generally stem from their service, but instead from within your organisation.

6. Most importantly, be security aware

- Security starts with you. Using your systems and devices irresponsibly can result in unwanted consequences.

- Be wary of suspicious emails (i.e. do not click on unfamiliar links or open unfamiliar attachments)

- Be careful when browsing online, as some sites will infect your computer just by visiting a website.

- Subscribe to Stay Smart Online – https://www.communications. gov.au/what-we-do/internet/stay-smart-online – an Australian Government service that provides alerts of major security issues to anyone, from individuals through to large scale businesses. The site includes useful information on identifying scams, protecting your identity and keeping your computers safe.