-

Strategic Partnerships: Unlock Growth, Innovation, and Efficiency in Wealth Management

The Australian wealth management landscape is undergoing a period of unprecedented transformation. Increased competition from both established players and disruptive fintechs, coupled with rising client expectations for personalized, digitally-driven experiences, is putting immense pressure on firms to innovate and deliver value efficiently. For wealth professionals and wealth technology/fintech firms alike, the temptation to “do it…

-

Why Are the Top 5 Predictions for Wealth Management the Same as 10 Years Ago?

Are We Finally Ready to Realise the Potential? The wealth management industry in Australia is at a critical juncture. For over a decade (and longer), we have been predicting transformative changes in the way wealth is managed, from digital transformation to personalisation, ESG investing, and the rise of hybrid advisory models. Yet, despite the fanfare,…

-

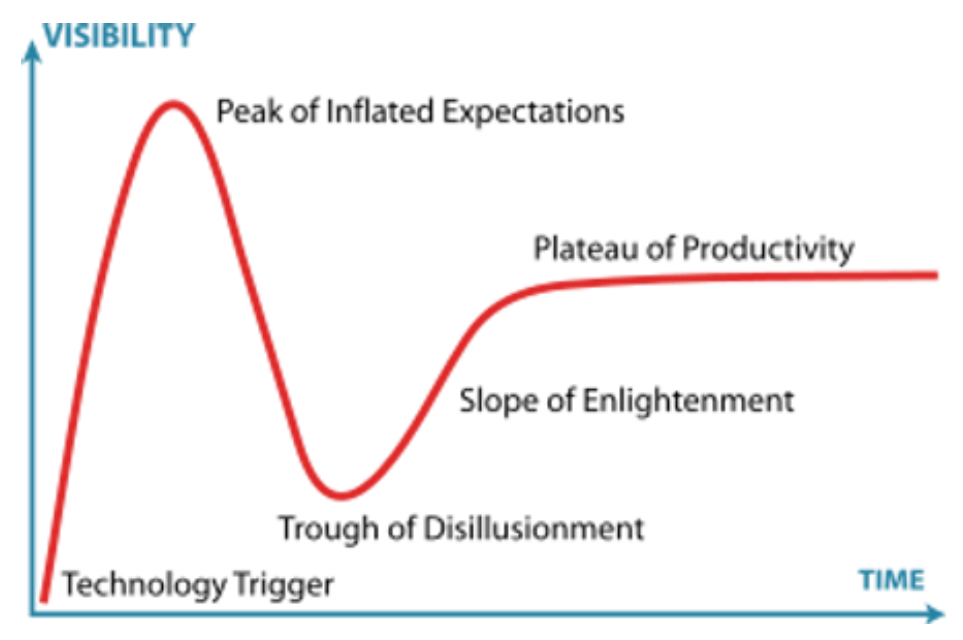

Blockchain’s Reality Check: Has it Delivered on the Hype?

The blockchain narrative, once steeped in promises of revolutionary disruption, decentralization, and unprecedented transparency, has begun to face a stark reality check. While the technology’s potential remains a subject of intense interest, its practical impact has fallen short of its initial, lofty claims. This article examines the dichotomy between blockchain’s aspirational goals and its present-day…

-

Artificial Intelligence and the Future of Financial Advice in Australia: Opportunities, Challenges, and Strategic Implications

I. Executive Summary Artificial intelligence (AI) stands poised to revolutionize the Australian financial advice landscape, offering the potential for increased efficiency, personalized advice at scale, and enhanced client engagement. However, this transformation is not without its challenges. This article explores the opportunities and risks associated with AI adoption, emphasizing strategic imperatives for wealth management platforms,…

-

Realising the preventative power of genetic information

Why the life insurance industry needs to rethink its approach to genetic testing. Should such genetic test information indicate the applicant has an increased risk of a disease or illness, insurance companies can and do use this information as the grounds for limiting cover through exclusions, reducing the term of the cover, charging higher premiums…

-

Life Insurance 2020+ – Prepare to be disrupted

While life insurance companies are busy dealing with business as usual imperatives, game changing social and digital trends are unfolding that stand to turn the industry on its head. A number of key trends impacting the life insurance industry are here already, while others are just around the corner. Then there are the future trends…

-

Technology and innovation: Priorities for the new era of superannuation

We conducted a poll of superannuation professionals at a recent conference in Melbourne, yielding some interesting results. We sought to ascertain the general sentiment in terms of business and technology priorities and what it will take to differentiate in this new era; post-GFC, post-SuperStream and post-MySuper – at the dawn of innovation. Reaching for the…

-

Strategies for managing technology through the cycle

As optimism floods back into the Asia Pacific region, the life insurance industry is gearing up for increased competition again. Darren Stevens, Global Head of Product – Wealth Management, Bravura Solutions, discusses what CIOs are saying in this new business environment and the IT strategies needed to support life insurers today and for the future.…

-

Superannuation: efficiency crisis?

Firstly, a warning; some may be surprised by what I’m about to convey given my background and field of expertise, heading up one of the leading suppliers of specialist IT platforms to the financial services sector. I have worked with numerous clients in the superannuation industry, and have firsthand experience of some of the critical…

-

Life insurance providers – compete or consolidate

The life insurance industry has not escaped the impact of the global financial crisis, and in the present economically uncertain times, where new business premiums have dropped more than 50% globally, insurers have a new set of challenges to face. Celent’s 2008 paper, Bad News on the Street, Insurance IT and the Financial Crisis, reports…

Search

About

Darren Stevens is a qualified fellow of the Actuaries Institute of Australia and has been working in the Wealth Management and Fintech sectors for over 38 years. These blogs are desired to assist executives in the wealth industry and other interested observers understand a little more about the workings and issues faced.

Archive

Recent Posts

- Strategic Partnerships: Unlock Growth, Innovation, and Efficiency in Wealth Management

- Why Are the Top 5 Predictions for Wealth Management the Same as 10 Years Ago?

- Which Costs More: Keeping It In-House or Outsourcing?

- Is Your Superannuation and Pension Safe? The Cybersecurity Challenges Looming Over the Sector

- Can Fintech Help Save the Planet? Discover the Sustainable Future of Finance!

Social Media

Gallery