-

Realising the preventative power of genetic information

Why the life insurance industry needs to rethink its approach to genetic testing. Should such genetic test information indicate the applicant has an increased risk of a disease or illness, insurance companies can and do use this information as the grounds for limiting cover through exclusions, reducing the term of the cover, charging higher premiums…

-

The Australian wealth management industry – 2020 and beyond

Future proofing amid rapid technological change – which way now for platform providers In the next five years, social and technological trends are going to transform business practices globally and alter the Australian wealth management landscape. For platform providers, this represents a ‘sliding doors’ moment… Here’s why you should proactively prepare for the future, rather…

-

Top social and technology changes impacting the SMSF sector

Introduction A number of years ago, Bill Gates presciently observed that: “Banking is essential, banks are not”. In the interim, we have seen the emergence and rising popularity of peer-to-peer lending, crowdfunding and new payment platforms, along with disrupters like Apple and PayPal, all pushing their way into the traditional banking domain. On the back…

-

Top social and technology changes and their impact on the SMSF sector

Introduction A number of years ago, Bill Gates presciently observed that: “Banking is essential, banks are not”. In the interim, we have seen the emergence and rising popularity of peer-to-peer lending, crowdfunding and new payment platforms, along with disrupters like Apple and PayPal, all pushing their way into the traditional banking domain. On the back…

-

Life Insurance 2020+ – Prepare to be disrupted

While life insurance companies are busy dealing with business as usual imperatives, game changing social and digital trends are unfolding that stand to turn the industry on its head. A number of key trends impacting the life insurance industry are here already, while others are just around the corner. Then there are the future trends…

-

Technology and innovation: Priorities for the new era of superannuation

We conducted a poll of superannuation professionals at a recent conference in Melbourne, yielding some interesting results. We sought to ascertain the general sentiment in terms of business and technology priorities and what it will take to differentiate in this new era; post-GFC, post-SuperStream and post-MySuper – at the dawn of innovation. Reaching for the…

-

Australian wealth management: What will be in 2014 and beyond?

2013 has been a busy but exciting year for the Australian wealth management industry. Thankfully though, the year has also marked the home stretch in terms of the recent spate of regulatory change; super funds are gradually getting their MySuper licences approved, the first part of SuperStream (rollovers) was implemented and the first Fee Disclosure…

-

Harnessing technology to accommodate shifting trends in insurance distribution

Emerging diversity in distribution – what does this mean for technology? “Forward thinking insurers are leveraging distribution channels as one way to capture the opportunities that exist in the fast growing Asia Pacific markets” – More than one approach. Alternative insurance distribution models in Asia Pacific, Deloitte Touche Tohmastu, 2010. According to a recently published…

-

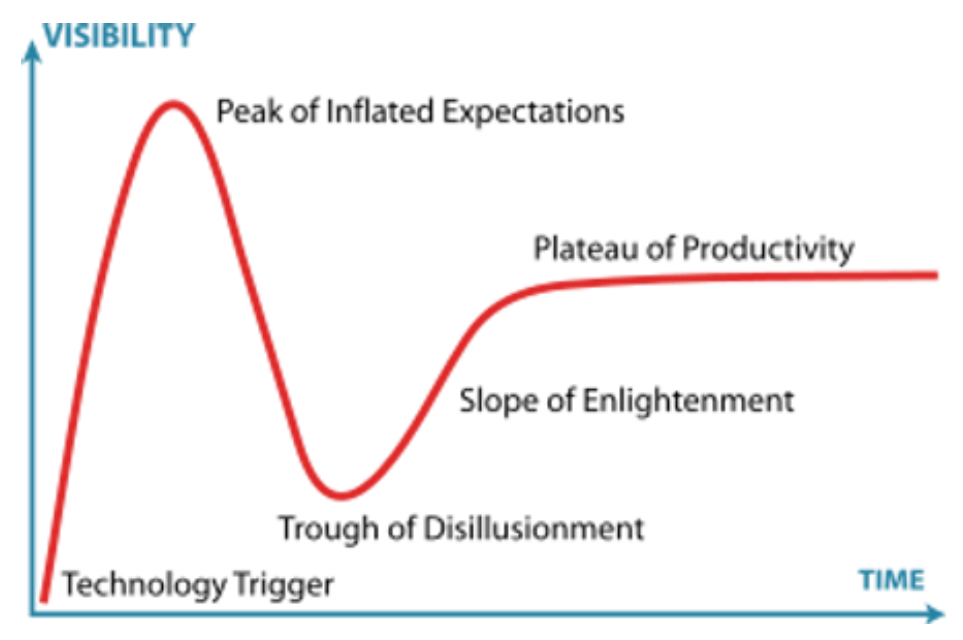

Strategies for managing technology through the cycle

As optimism floods back into the Asia Pacific region, the life insurance industry is gearing up for increased competition again. Darren Stevens, Global Head of Product – Wealth Management, Bravura Solutions, discusses what CIOs are saying in this new business environment and the IT strategies needed to support life insurers today and for the future.…

-

MySuper – what’s in store for super funds?

Following the release of the Cooper Review proposal, the Australian Superannuation industry is bracing for its next big change. The report – compiled by Jeremy Cooper, the former Deputy Chairman of ASIC – proposes the introduction of MySuper which, according to the 2010 Australian Government report MySuper, Optimising Australian Superannuation is “…a product with a…

Search

About

Darren Stevens is a qualified fellow of the Actuaries Institute of Australia and has been working in the Wealth Management and Fintech sectors for over 38 years. These blogs are desired to assist executives in the wealth industry and other interested observers understand a little more about the workings and issues faced.

Archive

Recent Posts

- Strategic Partnerships: Unlock Growth, Innovation, and Efficiency in Wealth Management

- Why Are the Top 5 Predictions for Wealth Management the Same as 10 Years Ago?

- Which Costs More: Keeping It In-House or Outsourcing?

- Is Your Superannuation and Pension Safe? The Cybersecurity Challenges Looming Over the Sector

- Can Fintech Help Save the Planet? Discover the Sustainable Future of Finance!

Social Media

Gallery